Tech Steadies as Credit Fears Cool

Strength in software and semiconductors offset lingering pressure from regional bank woes, giving bulls a late‑week relief rally as Treasury yields steadied and risk appetite cautiously returned.

The Nasdaq‑100 (NQ) rose 0.72%, closing near session highs after bouncing off early weakness tied to regional bank concerns. Market tone leaned cautiously risk‑on, helped by calming Treasury markets and a tentative rebound in megacap tech. The move marked a reset from Thursday’s selloff sparked by loan‑loss headlines and trade friction.

Key Movers

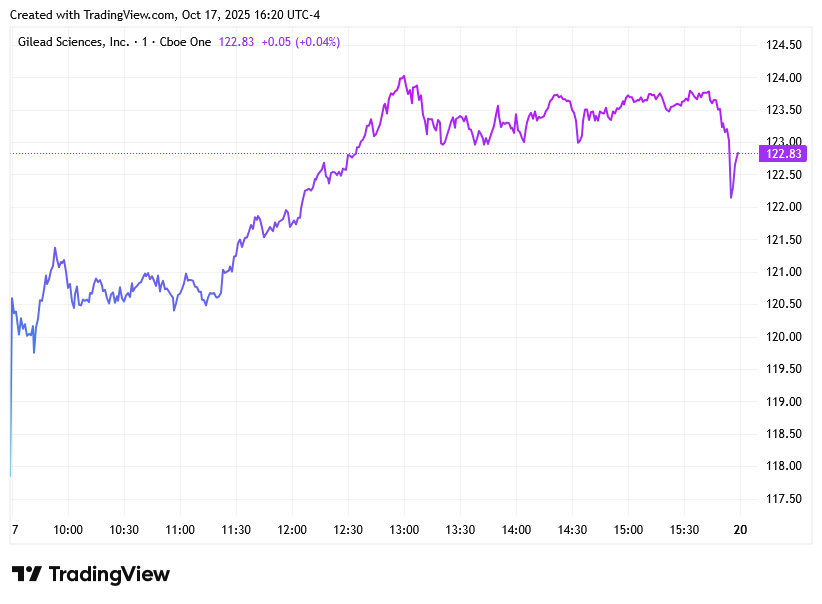

GILD +4.21% — Gilead led healthcare higher as investors rotated toward defensives after a supportive FDA panel vote.

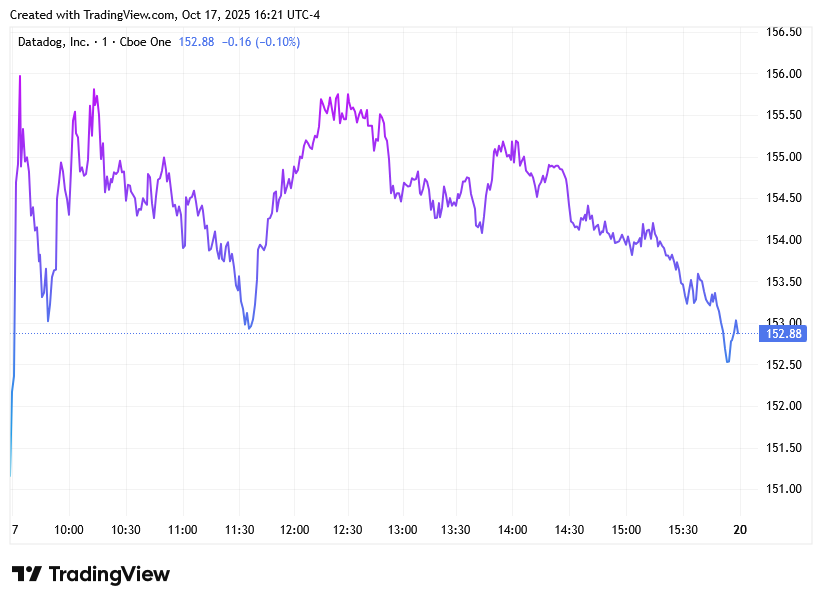

DDOG +1.12% — Datadog rallied on continued AI‑driven infrastructure demand and upbeat analyst commentary ahead of earnings.

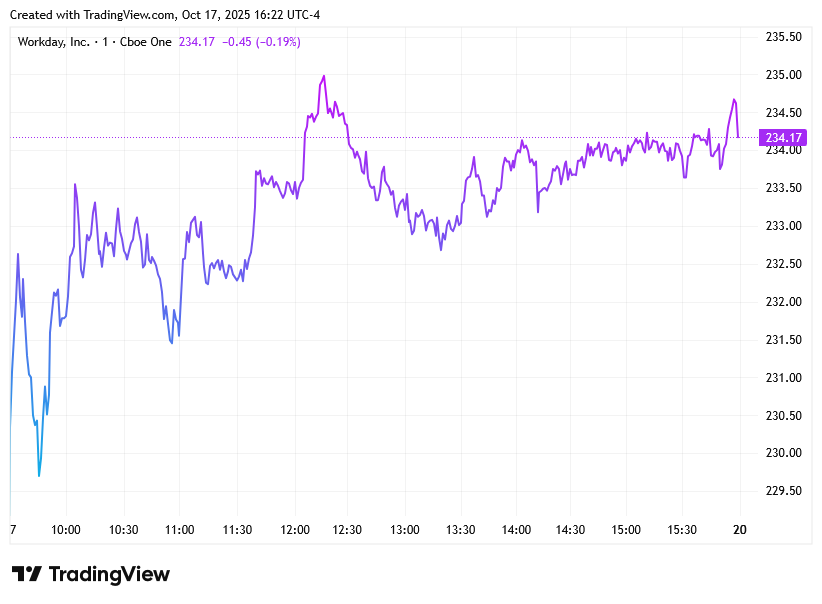

WDAY +2.92% — Workday gained on strong enterprise software bid, extending rebound momentum into quarter‑end.

CSX +1.69% — Rail operator popped as transport cyclicals found relief on easing freight cost data.

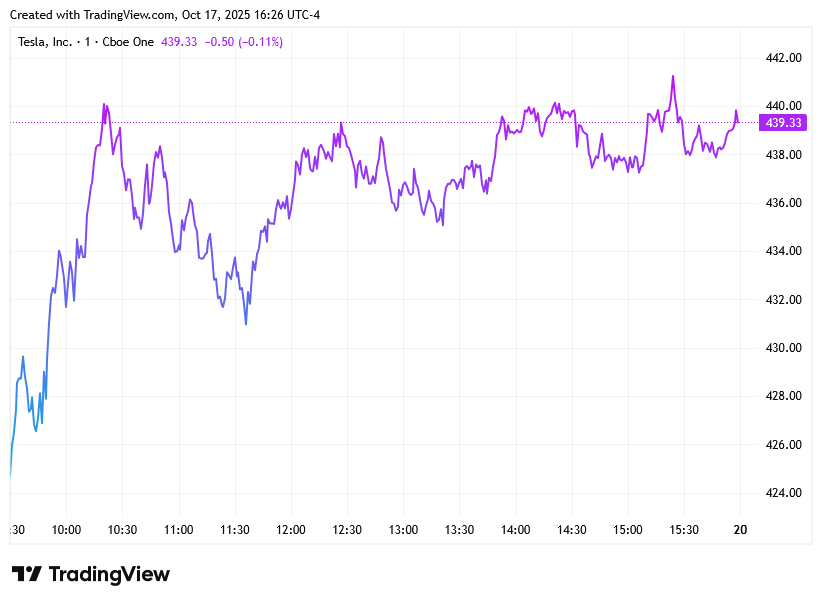

TSLA +2.46% — Tesla recovered some of the week’s losses, aided by optimism around next week’s delivery guidance announcement.

Sector Breakdown

Tech and biotech steadied after two bruising sessions, while large‑cap software and semiconductors led the Nasdaq‑100’s gains. Consumer staples joined the advance, mirroring broader defensive inflows. Financials and regional banks remained the week’s drag, with the SPDR Regional Banking ETF (KRE) still down more than 6% on the week.

Macro & Sentiment

Traders remained fixated on credit health after fresh reports of bad loans at mid‑tier U.S. banks. The shock sent the VIX to 25.3 (its highest level since May) though volatility moderated into Friday’s close. U.S.–China trade rhetoric also eased after President Trump suggested progress in upcoming tariff talks, softening the week’s earlier risk‑off undertone. Yields ticked higher but stayed contained near 4.6% on the 10‑year, allowing a modest equity bid to resurface. Stocks broadly showed resilience as investors recalibrated exposure ahead of a dense earnings calendar.

Technical Structure

Friday’s Nasdaq‑100 session completed a clean reaction from the 24,411.25 demand tag set earlier in the week. After probing below Tuesday’s marked level, price stabilized inside the 24,510–24,550 pocket — an area that drew responsive buyers and marked the day’s structural low. From there, liquidity rotated upward through 24,750, initiating a reclaim toward the prior value zone.

Mid‑session, price accepted above 24,820, confirming buyer control and reinforcing short‑term accumulation. Into the close, the index stalled just under 24,880, where a lingering imbalance from Wednesday’s breakdown capped upside progress.

Closing Reflection

After a tense week dominated by banking stress headlines, tech strength offered a stabilizing cue into the weekend. With index volatility still elevated, traders face a tug of war between improving earnings momentum and credit repricing risk. Next week’s macro calendar, including PMI data and big‑tech earnings, will determine if this bounce has real legs.

What’s your plan heading into Monday’s trade, fade this relief or position for an early‑week continuation?