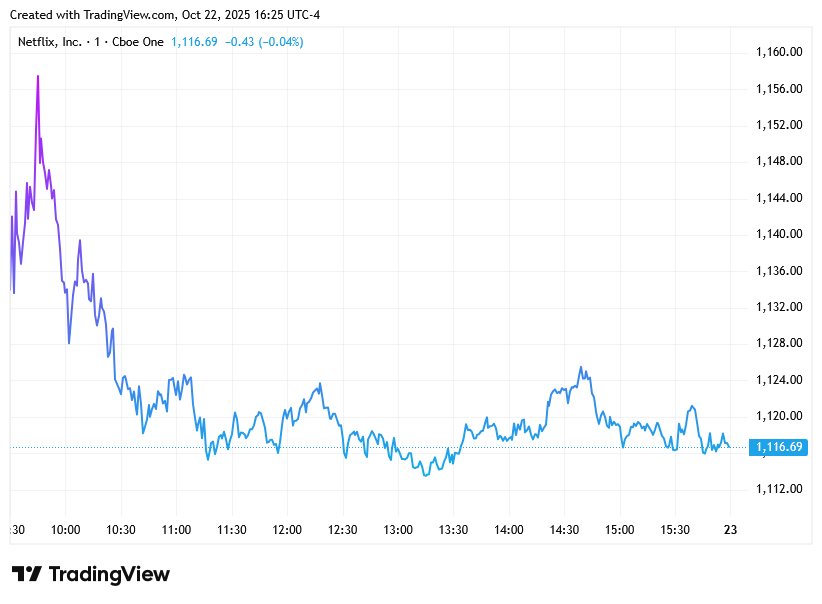

Netflix Drags Tech — $NQ Slips as Earnings Momentum Fades

The Nasdaq‑100 slid 0.8% on Wednesday to close near 25,090 as weak earnings from major components tempered recent optimism.

Traders rotated out of mega‑cap tech following Netflix’s steep post‑earnings drop and cautious guidance from Texas Instruments. Overall sentiment leaned risk‑off with defensive allocation evident ahead of Tesla’s report after the bell.

Key Movers

NFLX −10.07% — Disappointed investors with earnings miss and a tax dispute in Brazil, knocking sentiment across streaming names.

TXN −5.6% — Posted lackluster chip guidance, reinforcing concerns over softening semiconductor demand.

ISRG +13.89% — Surged after robust surgical robotics revenue and strong margin commentary.

WBD +3.6% — Benefitted from rotation into media names amid bargain hunting.

AAPL −1.64% — Traded weaker as investors favored broader cyclicals ahead of next week’s earnings.

Sector Breakdown

Semiconductors and software lagged sharply as earnings weighed, while consumer discretionary and media pockets showed brief rotation. Communication services fared better thanks to select gains in Warner Bros Discovery and Alphabet, while utilities and energy held flat in defensive fashion.

Macro & Sentiment

Treasuries firmed modestly, with the 10‑year yield easing to around 3.95% as traders trimmed expectations of another Fed hike this quarter. President Trump’s comments about potential tariff adjustments with China and India added mild uncertainty but limited follow‑through. The combination of soft guidance, profit taking, and cautious risk tolerance reflected traders’ preference to park capital ahead of Tesla’s critical earnings, the first among the “Magnificent Seven” this cycle.

Technical Structure

E‑mini Nasdaq‑100 futures (December contract) settled near 25,045, off roughly 0.8%, after testing the 25,338–25,350 liquidity pocket before fading into the close. Intraday, sellers defended the 25,300–25,350 supply shelf, triggering a rotation back into the 25,050–25,100 demand zone. Below 24,950, liquidity thins toward the 24,780–24,820 support pocket observed earlier this week, while recovery above 25,400 remains key for reclaiming bullish momentum toward 25,850–26,000.

Closing Reflection

Today’s pullback cooled speculative heat just as traders brace for Tesla’s print, a potential tone setter for mega‑cap momentum into week’s end. With earnings season shifting into high gear and bond yields stabilizing, tomorrow’s session will likely determine whether tech dips invite buyers or reinforce broader rotation.

What’s your plan heading into Thursday, fade strength or look for reclaims above 25,400?