Earnings Lift Tech

$NQ Grinds Higher as Fed Signals Patience

The Nasdaq‑100 (NQZ25) rose about +0.78% on Wednesday, closing at 24,941.25, boosted by strong Q3 bank earnings and growing conviction the Fed’s next move is a rate cut. Traders embraced a mild risk‑on tone, even as Washington’s fiscal standoff and simmering U.S.–China trade issues capped upside enthusiasm.

Key Movers

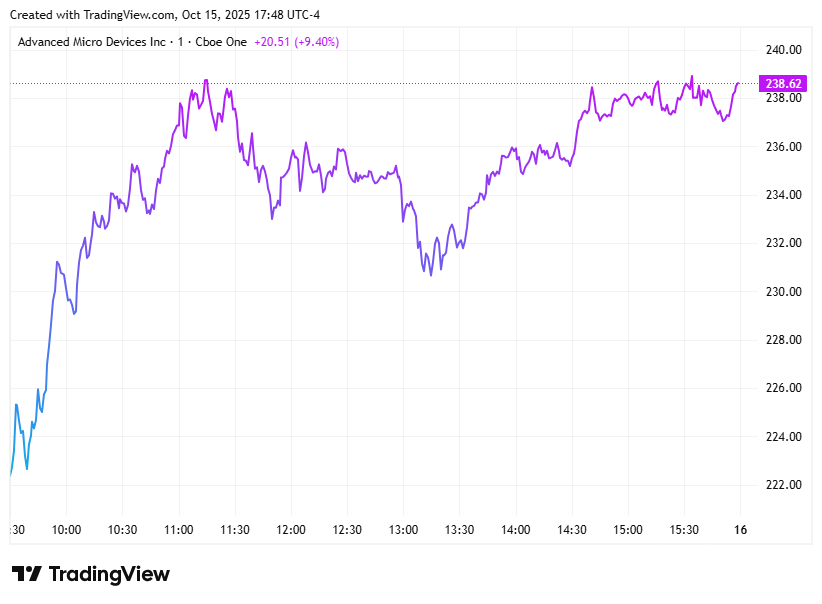

AMD +9.4% — surged after announcing a chip supply agreement with Oracle, pushing semiconductors to fresh monthly highs.

ASML +2.71% — reported strong demand for AI chipmaking equipment, reinforcing optimism across the sector.

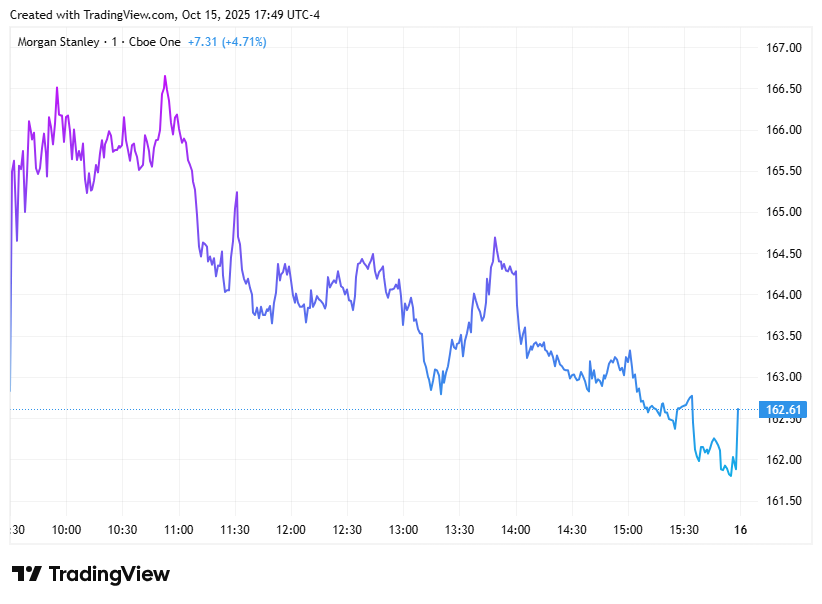

MS +4.71% — crushed earnings expectations on investment banking strength.

BAC +4.37% — extended rally after delivering profit gains across business lines.

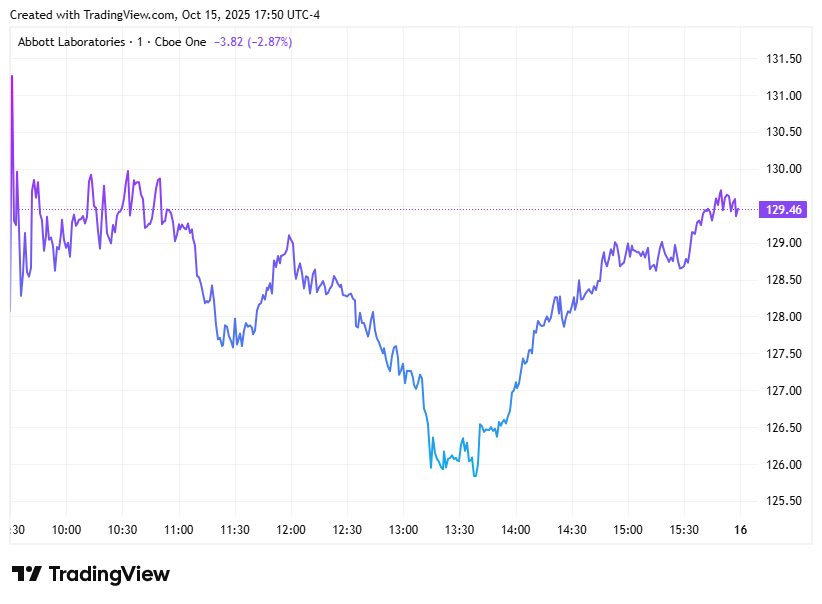

ABT -2.4% — slipped after trimming full‑year earnings guidance.

Sector Breakdown

Semiconductors and financials led the charge, while health care and consumer defensives lagged as funds rotated into cyclical risk. AI, cloud, and chip names provided the bulk of the upward pressure in the Nasdaq‑100, offsetting weakness in pharma and biotech.

Macro & Sentiment

Federal Reserve Chair Jerome Powell struck a measured tone, hinting that downside economic risks have increased and further easing could be warranted later this year. Treasury yields were mostly flat near 4.04%, and traders priced a 98% chance of a 25‑bp rate cut at the next FOMC meeting. Meanwhile, renewed U.S.–China trade tensions lingered but failed to derail momentum, as investors focused on positive earnings surprises from major banks and tech.

Technical Overview

$NQ held firm above 24,700 support, rebounding toward 24,920 resistance, in line with the October range seen across higher timeframes. A break above 24,950–25,000 opens the door toward the October highs near 25,200, while a reversal below 24,700 could warn of another test of 24,200 support.

Closing Reflection

Tech and financial earnings gave bulls fresh fuel, but macro clouds linger, particularly around trade and fiscal policy.

What’s your read heading into Thursday, bullish continuation or fade‑the‑rally setup?