Cautious Relief Rally — $NQ Rebounds as Earnings Reset Expectations

The Nasdaq‑100 clawed back 0.88% to close near 25,115 after Wednesday’s selloff, with traders digesting a mix of corporate earnings and moderating bond yields.

Sentiment leaned cautiously risk‑on as megacaps helped stabilize broader tech momentum while rate expectations continued to temper.

Key Movers:

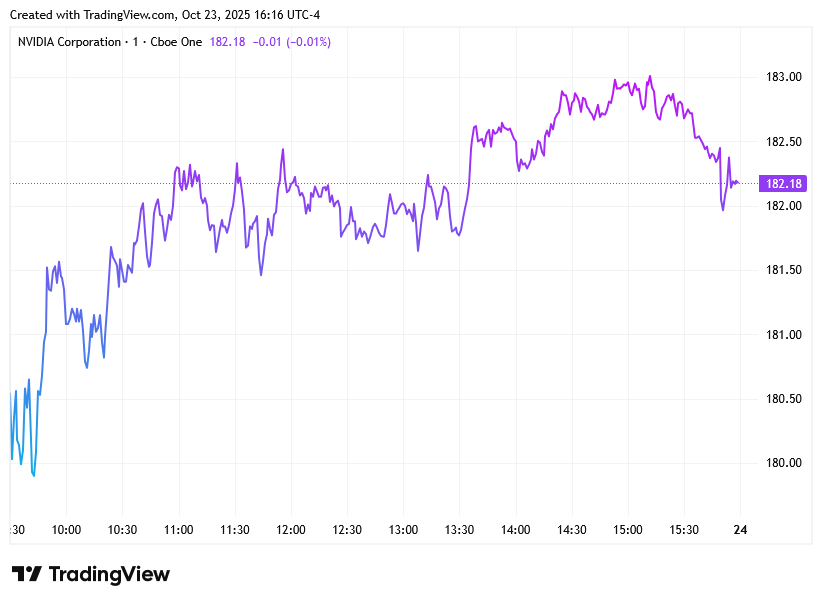

NVDA +1.04% — Strength in AI demand pushed semis higher, offsetting weakness in smaller chip names.

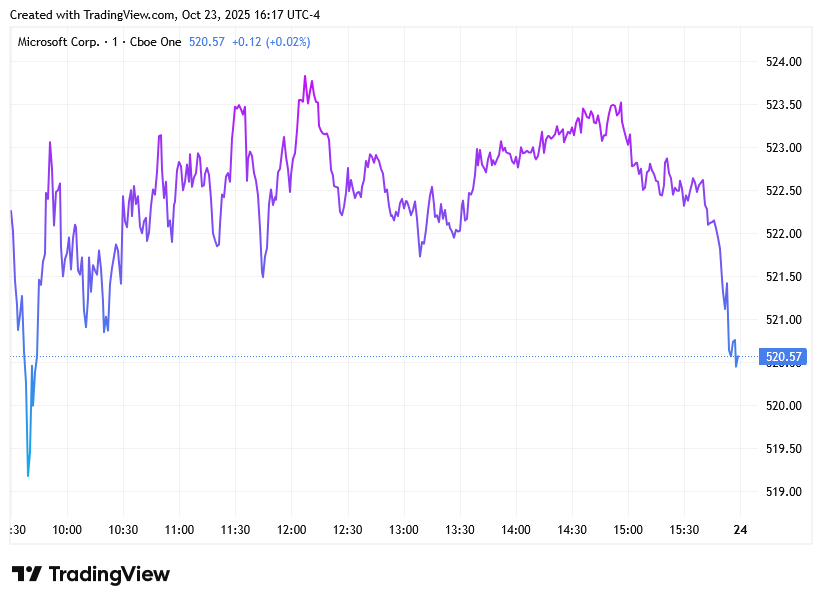

MSFT +0.0% — Cloud segment resilience and bullish commentary from peers kept buyers active above 25,000.

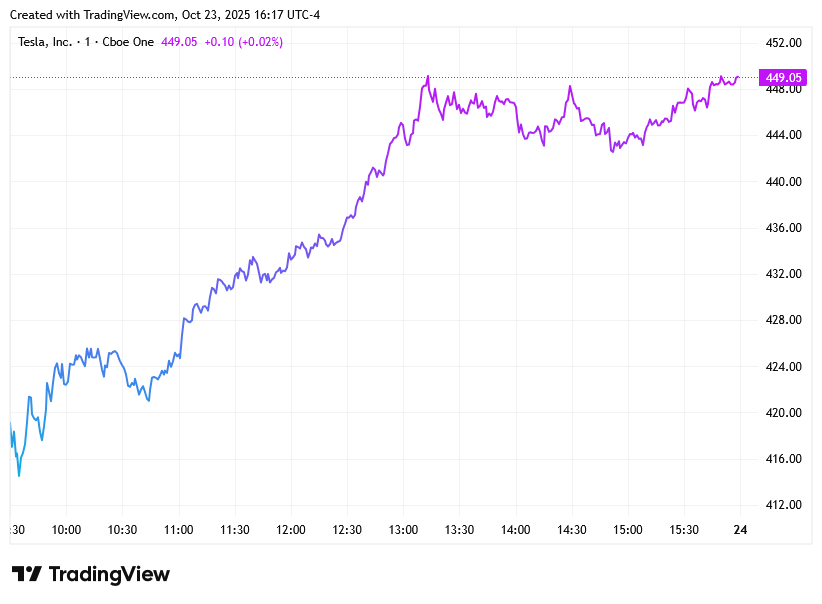

TSLA +2.28% — Post‑earnings fallout persisted as margin compression overshadowed delivery growth.

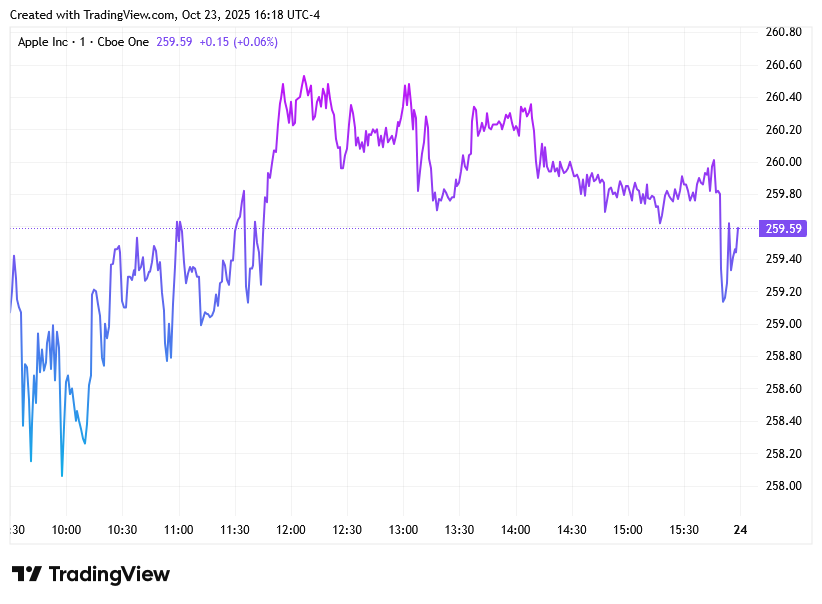

AAPL +0.43% — Defensive rotation favored Apple after iPhone guidance calmed supply‑chain worries.

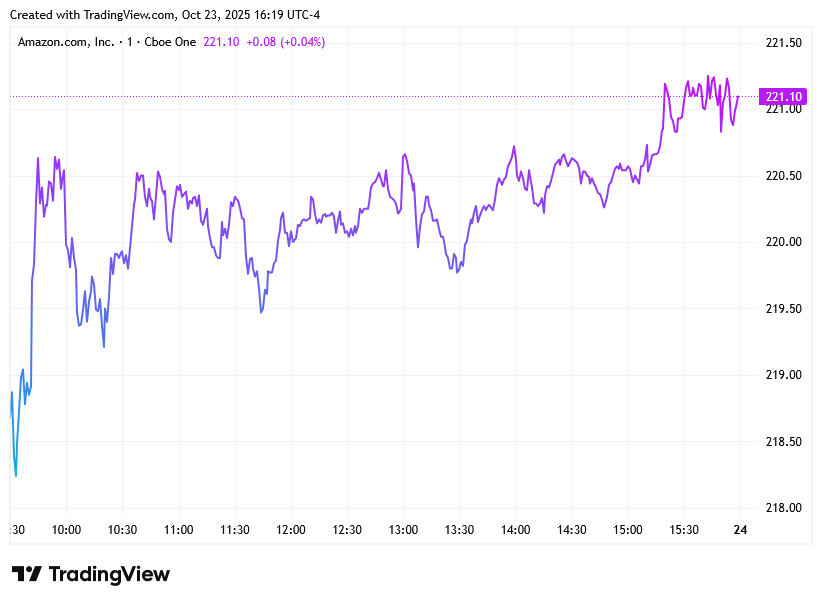

AMZN +1.44% — Retail optimism resurfaced ahead of Q3 GDP data, with traders eyeing consumer strength.

Sector Breakdown:

Tech and semiconductors led a measured rebound, with communication services following close behind. Consumer discretionary lagged due to Tesla’s drag, while health care and biotech remained muted.

Macro & Sentiment:

Thursday’s recovery reflected cooling Treasury yields, the 10Y slipped to 3.99%, providing breathing room for duration‑sensitive tech names. Earnings from Honeywell and Intel hinted at stabilizing industrial demand, easing concerns about a broader growth slowdown. Market participants remain wary of inflation stickiness, but softening energy prices and stable dollar flows reduced immediate volatility pressure. Positioning stayed light ahead of Friday’s PCE and GDP prints,keeping liquidity rotations tight and tactical.

Technical Structure:

$NQ defended the 24,940–24,980 demand pocket established from Wednesday’s liquidation, holding a higher‑low into midday trade. Price reclaimed liquidity above 25,100 and sustained acceptance through 25,150, signaling responsive buyers. Immediate resistance rests around 25,320, the prior sweep zone from October 21. A breakout above could open continuation toward 25,550–25,650, while failure to hold 25,000 risks a retest of 24,780 liquidity. Intraday bias remains constructive unless a late‑week macro shock forces another rotation into defensives.

Closing Reflection:

Today’s bounce stabilized tech sentiment but came amid thin conviction — more a sigh of relief than start of a new leg. Tomorrow’s PCE inflation and GDP data will test whether this recovery can extend into the week’s close.

What’s your move heading into Friday, fade the rip or ride the follow‑through?

The part about AI demand pushing semis higher realy stood out to me. Your read on the tech rebound is spot-on. I am curious how much of that AI strength is from new aplications versus existing enterprise upgrades.